Traveling without a budget can lead to overspending and unnecessary stress, leaving you scrambling to find ways to cover unexpected costs. To ensure a smooth and enjoyable trip, creating a travel budget is essential. This comprehensive guide will walk you through the process of planning a budget for your next adventure, using a downloadable travel budgeting template that simplifies your financial planning.

Whether you’re a weekend adventurer or a long-term explorer, this guide is perfect for anyone looking to keep their travel expenses under control. From pre-trip planning essentials to step-by-step budgeting, tracking your expenses, and avoiding common mistakes, we’ve got you covered.

Don’t miss our free travel budgeting template, your ultimate trip-planning companion that will help you stay organized and financially prepared throughout your travels!

Proper planning is the foundation of a successful travel budget. Whether you’re embarking on a short getaway or a month-long adventure, factoring in the essentials before you travel can save you time, money, and stress. With a well-structured travel budgeting template, you’ll have the perfect tool to estimate costs and align your trip with your financial goals. Here’s how to plan effectively:

1. Determining Trip Duration and Timing

Your trip’s timing can significantly impact your budget. Here’s what to consider:

- Peak vs. Off-Peak Season Considerations:

Traveling during peak seasons (such as summer vacations or holidays) often means higher costs for flights, accommodations, and activities. Conversely, off-peak seasons may offer substantial discounts, but certain attractions or services might be unavailable. Use your travel budgeting template to compare price variations by season and choose the best balance between cost and experience. - Impact of Seasonal Pricing and Special Events:

Research whether seasonal changes or special events will affect your destination. For instance, festivals or sporting events can drive up costs for accommodations and transportation. A budgeting template can help you adjust estimates for such scenarios. - Optimal Booking Windows

Plan ahead to take advantage of the best booking windows. Typically, flights and accommodations are cheaper when booked several weeks or months in advance. Add a timeline to your budgeting template to track key booking milestones and avoid last-minute price hikes.

2. Choosing a Destination

Selecting the right destination is crucial to staying within your budget. Here’s how to evaluate options:

- Researching Cost of Living and Exchange Rates:

The cost of daily expenses varies widely between destinations. Research average food, transportation, and accommodation prices, and factor in exchange rates. Your travel budgeting template can include an exchange rate calculator to estimate the cost in your home currency. For example, if you’re planning to explore Europe, check out our guide to The Best Places to Visit in France: Top 7 Destinations and Travel Deals to discover budget-friendly destinations and exclusive travel offers. - Comparing Multi-Destination vs. Single-Location Trips:

Multi-destination trips might seem exciting, but they often incur higher transportation and logistical costs. A single-location trip can be more budget-friendly. Use your template to compare both options and decide what aligns with your goals. If Madagascar is on your list, our article on The Best Places to Visit in Madagascar: Must-See Destinations for Every Traveler provides insight into cost-effective and must-see destinations. - Accessibility and Transportation Costs:

Consider how easy it is to reach your destination. Direct flights, proximity to major transportation hubs, or the need for additional transfers can impact costs. Use the budgeting template to account for all transportation-related expenses, including airport transfers, train fares, or local travel options.

3. Understanding Local Financial Considerations

Understanding a destination’s financial norms can help you avoid unnecessary expenses.

- Regional Pricing Variations:

Prices for goods and services can vary widely, even within the same country. Research average costs for meals, transportation, and activities specific to your destination. Factor in these variations when filling out your budgeting template. - Tipping Customs and Haggling Norms:

In some regions, tipping is expected, while in others, it’s unnecessary. Similarly, haggling might be a standard practice in local markets. Account for these cultural norms in your budget and ensure your template includes a category for tips and miscellaneous expenses. - Local Payment Methods and Preferences:

Find out whether cash or cards are more commonly used. Some destinations may charge fees for card payments or have limited ATM access. Add a section in your template to track ATM fees, currency exchange costs, or cash needs.

By thoroughly planning your trip’s duration, destination, and financial considerations, you’ll be better prepared to stay within budget. A travel budgeting template makes it easy to organize these factors, ensuring no detail is overlooked. Use this step as the starting point for crafting a budget that works for you, leaving more room for enjoyment and fewer financial surprises!

Why Do You Need a Travel Budget?

Traveling is one of life’s greatest joys, but without proper budgeting, it can quickly lead to overspending and unnecessary stress. Creating a travel budget is essential to ensure you make the most of your trip while staying financially secure. Using a travel budgeting template can make this process seamless and efficient.

1. Benefits of Budgeting

Here’s why every traveler should prioritize budgeting:

- Financial Control and Peace of Mind:

A well-planned budget puts you in charge of your spending. Knowing exactly how much you can allocate to transportation, accommodation, food, and activities helps you avoid financial surprises and lets you travel with confidence. - Stress-Free Travel:

When you have a clear plan for your expenses, you can focus on enjoying your trip rather than worrying about money. A budgeting template ensures that every cost is accounted for, reducing last-minute stress. - Better Planning for Memorable Experiences:

By budgeting, you can allocate resources to what matters most whether it’s a once-in-a-lifetime tour, an incredible dining experience, or exploring a hidden gem. Budgeting helps you prioritize the experiences that will make your trip unforgettable.

2. How the Travel Budgeting Template Simplifies Your Planning

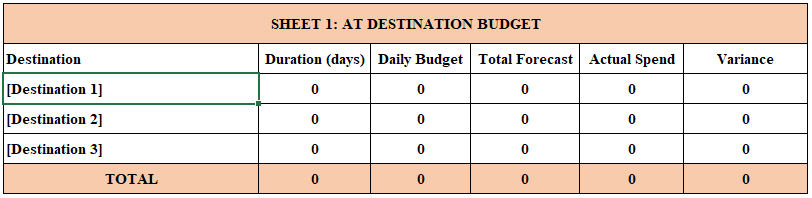

Using a travel budgeting template takes the guesswork out of financial planning. Here’s how it streamlines the process:

- Organized Expense Tracking:

The template provides a structured framework for categorizing your expenses—transportation, accommodation, food, activities, and more. With everything laid out, you can easily track where your money is going and ensure no category is overlooked. - Clear Category Allocation:

A good budgeting template allows you to set limits for each expense category. This clarity helps you make informed decisions, such as adjusting your accommodation budget to accommodate a special activity. - Easy Adjustments and Real-Time Updates:

Travel plans often change, and so do costs. A flexible travel budgeting template lets you update your budget on the go, ensuring you stay on track no matter what surprises come your way. - Historical Data for Future Trips:

Your completed budgeting template serves as a valuable reference for future adventures. It offers insights into realistic costs for specific destinations, helping you plan even more efficiently next time.

A travel budget isn’t just a tool; it’s your roadmap to a stress-free and fulfilling trip. By using a travel budgeting template, you gain financial control, minimize stress, and ensure you focus on the experiences that matter most. Start your travel planning journey with this essential tool, and set the stage for an adventure to remember!

Researching Key Cost Areas

When creating a travel budget, it’s important to account for all major cost areas to avoid unexpected expenses. Here’s a detailed breakdown of the key categories to include in your travel budgeting template:

1. Transportation

Transportation is often one of the largest expenses when planning a trip, so careful consideration is essential.

- Flights: Start by estimating ticket prices for your destination. Don’t forget to include baggage fees, seat selection charges, and any other additional costs that airlines may impose.

- Local Travel: Research options for getting around at your destination. Budget for taxis, rideshares, car rentals, fuel, or public transit passes, depending on your travel style.

- Airport Transfers: Account for the cost of traveling to and from airports, whether by shuttle services, private cars, or public transportation.

2. Accommodation

Where you stay can have a significant impact on your overall budget.

- Hotels: Look up nightly rates for hotels in your destination and factor in taxes, service charges, or resort fees that may apply.

- Vacation Rentals: Explore options like Airbnb or Vrbo for cost-effective accommodations, especially for group trips or extended stays.

- Hostels and Guesthouses: For budget-conscious travelers, hostels or guesthouses can be an economical choice. Research the average cost per night and the amenities included.

3. Food and Drink

Food is an integral part of the travel experience, but costs can vary widely depending on your preferences.

- Restaurants: Research average meal prices at your destination. Consider the cost of casual dining, fast food, and fine dining experiences.

- Grocery Shopping: If you plan to prepare your own meals, include the estimated cost of groceries in your budget.

- Local Cuisine: Don’t forget to allocate funds for trying regional specialties or unique dining experiences, such as street food or high-end restaurants.

4. Activities

Activities and excursions can be the highlight of your trip, but they also come with a price tag.

- Tours and Excursions: Estimate costs for guided tours, adventure activities, or specialized experiences you want to include in your itinerary.

- Entrance Fees: Many destinations have entry fees for museums, national parks, historical sites, or cultural attractions. Research and budget accordingly.

- Equipment Rentals: For certain activities, you may need to rent equipment like bikes, kayaks, or ski gear. Include these costs in your plan.

- Special Events: If your trip coincides with festivals, concerts, or sports events, ensure you budget for tickets and related expenses.

5. Miscellaneous Expenses

These often-overlooked costs can add up quickly, so it’s essential to plan for them.

- Travel Insurance: Protect yourself against unexpected emergencies or trip cancellations by including the cost of a comprehensive travel insurance policy.

- Visa Fees: Research the entry requirements for your destination and budget for visa application fees, if necessary.

- Shopping and Souvenirs: Allocate a portion of your budget for personal purchases, gifts, or mementos to bring back home.

- Emergency Fund: Set aside a contingency amount to cover any unexpected expenses, such as medical emergencies, lost items, or last-minute changes to your itinerary.

By thoroughly researching and estimating costs for each of these categories, you can create a realistic and comprehensive travel budget. Incorporating these details into your travel budgeting template will ensure you’re well-prepared for all aspects of your journey, leaving you free to enjoy your adventure stress-free.

Creating Your Travel Budget: Step-by-Step

Planning a travel budget might seem overwhelming, but using a travel budgeting template can simplify the process. Follow this detailed step-by-step guide to create a budget that keeps you on track before and during your trip.

Step 1: Set a Total Budget

Before diving into the specifics, it’s essential to assess how much money you can allocate for your trip. Start by evaluating your savings, monthly income, and any additional funds you can set aside, such as rewards points from credit cards or loyalty programs.

- Assess Savings: Look at how much you already have saved and decide if it’s sufficient for the trip you have in mind. If not, establish a savings plan.

- Earning Capacity: Factor in how much you can earn between now and your trip. This may include any extra work, side gigs, or freelance opportunities.

- Rewards Points: If you have accumulated airline miles or hotel loyalty points, see if they can be redeemed for flights, accommodations, or other travel-related expenses.

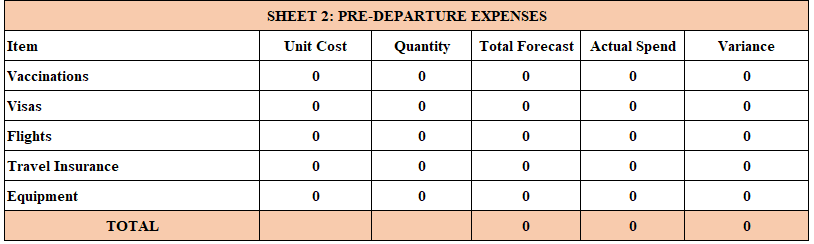

- Pre-trip Expenses: Don’t forget to include any upfront costs you need to cover before the trip begins, such as visas, gear, vaccinations, and any other preparations. These costs are just as important as the travel itself and should be factored into your total budget.

Step 2: Break Down Expenses

Once you’ve set your total budget, it’s time to allocate it into specific categories. A travel budgeting template is perfect for this task, as it helps you organize your expenses clearly.

- Category Allocation: Break down your budget into categories such as transportation, accommodation, food, activities, insurance, and miscellaneous expenses. This ensures no aspect of your trip is overlooked.

- Prioritize Spending Categories: Rank your categories based on importance. For example, flights and accommodation may take precedence over activities, depending on your travel style.

- Fixed vs. Variable Costs: Identify costs that will remain constant (such as flight tickets) versus those that may vary (like food and activities). This distinction will help you plan for both predictable and flexible expenses.

Step 3: Allocate Daily Spending Limits

Once you’ve broken down your overall expenses, set realistic daily spending limits. This will help you stay within your budget while traveling and prevent overspending on individual days.

- High- and Low-Spending Days: Some days, like travel days or special events, may require a higher budget. Other days, like those spent exploring on foot or relaxing, may need a lower allocation. Plan accordingly.

- Set Realistic Daily Caps: Using your travel budgeting template, set a daily budget for both high and low-expense days. Having a clear daily cap helps you make smarter decisions on the go and ensures you won’t run out of money before the end of your trip.

Step 4: Add a Contingency Fund

No matter how well you plan, unexpected expenses can arise. To ensure you’re fully prepared, include a contingency fund in your budget.

- Buffer for Unexpected Costs: Add a buffer amount (typically 10-15% of your total budget) for emergencies or last-minute expenses that may come up, such as medical emergencies, unexpected delays, or changes in plans.

- Emergency Situations: Having a financial cushion means you won’t need to cut back on other important expenses if something unexpected arises.

Step 5: Track Expenses Before and During the Trip

Tracking your expenses is essential to staying on budget. Keeping a close eye on your spending, both before and during your trip, will help you avoid financial surprises.

- Choose Tracking Tools: There are various methods available, such as apps, spreadsheets, or physical notebooks. Find what works best for you. Apps like Mint or Expensify can make this task easy, while a spreadsheet gives you more control.

- Regular Expense Reviews: Set a reminder to review your expenses weekly. Regular check-ins will help you adjust as needed and ensure you’re on track.

Step 6: Choose Your Budgeting Tools

Choosing the right tool for tracking your expenses is key to staying organized. Depending on your preferences, you can go digital or traditional.

- Apps vs. Traditional Methods: If you prefer digital tools, budgeting apps like Trail Wallet or PocketGuard can be handy for real-time expense tracking. Traditional methods, like a printed travel budgeting template or a physical ledger, work well if you want a more hands-on approach.

- Automation: Many apps offer automation features that sync with your bank accounts and credit cards, automatically tracking and categorizing your expenses. Setting up this automation can save you time and effort during your trip.

Step 7: Plan for Budget Flexibility

While it’s important to stick to a budget, flexibility is key when traveling. Life happens, and sometimes plans change.

- Adjustment Periods: Build in periods where you can adjust your budget. If you spend less on food one day, you can reallocate the funds to another category, like activities.

- Reallocation Strategies: Stay flexible with your categories. If you have more left in your food budget but need more for activities, reallocate funds as necessary. This flexibility ensures your overall budget remains intact while you get the most out of your trip.

By following these steps and using a travel budgeting template, you can create a well-organized plan that covers all aspects of your trip. From setting a total budget to planning for flexibility, every step ensures you’re prepared for an enjoyable and stress-free travel experience.

How to Stay on Track with Your Budget

Once you’ve created your travel budget, the next challenge is to stick to it. Staying on track is essential for ensuring a smooth, stress-free trip without running into unexpected financial issues. With the help of a travel budgeting template, digital tools, smart habits, and regional money-saving strategies, you can ensure that your finances remain in check throughout your journey.

1. Digital Tracking Tools

The convenience of modern technology means you can easily track your expenses in real time, ensuring that you never lose sight of your budget while on the go. Using digital tools can simplify the process and keep you organized.

- Real-Time Expense Apps: Apps like Mint, Expensify and TrackWallet: Expense Tracker allow you to track your spending as it happens. These tools categorize your expenses and can sync with your bank accounts and credit cards, providing you with an accurate view of your spending at any given moment. With these apps, you don’t have to worry about losing receipts or trying to remember what you spent. The travel budgeting template can be integrated into these apps, so all your categories are clearly defined and updated automatically.

- Automated Tracking Systems: Some budgeting apps offer automated expense tracking. This means that as you make purchases, the system categorizes and records your expenses without you needing to manually enter each item. This can save you time and reduce the likelihood of missing a purchase. It’s a seamless way to stay on top of your budget without much effort.

- Group Budget Sharing: If you’re traveling with a group, sharing a budget is essential. Many digital tools like Splitwise or TravelMapper allow group members to track collective expenses and see who’s paid for what. This helps ensure that everyone is contributing fairly to shared costs like accommodation, meals, and transportation. Using a travel budgeting template designed for group travel can further streamline this process, giving everyone a clear picture of the budget and expenditures.

2. Regional Money-Saving Tips

While sticking to a budget is important, finding ways to save money based on your destination can make a significant difference. By leveraging local resources and taking advantage of regional money-saving tips, you can stretch your budget even further.

- Local Discounts: Many destinations offer discounts to tourists for things like public transportation, attractions, and even dining. Look for city cards, tourist passes, or special deals that offer bundled access to attractions at a lower price. For instance, in many cities, you can get a discount on museum tickets or public transport when buying a pass for multiple attractions. These discounts help you get the most value out of your travel spending while sticking to your travel budgeting template.

- Seasonal Deals: Prices can fluctuate greatly depending on the time of year, and this is especially true for travel-related services. Traveling during the off-season can save you significant amounts on flights, accommodations, and tours. Keep an eye out for seasonal promotions, and don’t hesitate to plan your trip around these price drops. Booking your trip for off-peak times is one of the easiest ways to reduce your overall expenses, ensuring that your travel budgeting template stays on track.

- Group Booking Opportunities: If you’re traveling with friends or family, look for group discounts. Many services, such as tours, transportation, and accommodations, offer discounts for larger groups. Pooling resources for group bookings helps reduce per-person costs, and these savings can be reinvested into other aspects of your trip. Group bookings are a great way to ensure that everyone sticks to the budget and still enjoys a fulfilling travel experience.

3. Simple Habits to Stay Budget-Conscious

In addition to using digital tools and regional tips, developing simple, everyday habits can significantly help you stay on track with your travel budget. With a few mindful practices, you can keep your spending in check without constantly monitoring your accounts.

- Use a Cash Envelope System: While digital tracking is incredibly useful, many travelers find it helpful to set aside cash for certain expenses, like meals, shopping, and activities. The envelope system involves withdrawing a set amount of cash for each category at the start of the trip and using only that cash for related purchases. Once the envelope is empty, no more spending occurs in that category for the day. This is an excellent way to stick to your travel budgeting template and avoid overspending.

- Perform Daily Reviews: Make it a habit to review your expenses at the end of each day. You can do this in conjunction with your travel budget tracking app or by using your travel budgeting template to manually input your daily expenses. A quick review helps you identify any areas where you may be overspending or areas where you can adjust for the next day. Daily reviews also allow you to celebrate successes, like saving money in one category, and ensure you’re on target for the remainder of your trip.

- Reward Under-Budget Days: Positive reinforcement can go a long way in helping you stick to your budget. On days when you spend less than expected, reward yourself by setting aside a small portion of the savings for a fun experience or treating yourself to something extra. It could be as simple as enjoying a nice dessert or treating yourself to a local experience you wouldn’t normally indulge in. This practice keeps you motivated to stay on track with your budget and gives you something to look forward to.

Your Attractive HeadinStaying on track with your travel budget doesn’t have to be difficult, especially when you use the right tools and habits. Whether it’s using a travel budgeting template to organize your expenses, leveraging digital tracking apps, or employing regional money-saving tips, there are many ways to ensure that your finances stay in check. By incorporating simple habits like the cash envelope system, daily expense reviews, and rewarding yourself for sticking to your budget, you’ll maintain financial control and enjoy a stress-free travel experience.g

Common Budgeting Mistakes to Avoid

When creating a travel budget, it’s easy to overlook certain costs, which can lead to unexpected financial stress. By being aware of common budgeting mistakes and using a travel budgeting template to keep track of every expense, you can ensure that you stay within your planned budget and avoid unpleasant surprises. Below are some key mistakes to watch out for:

1. Hidden Fees

Many travelers overlook the hidden fees that can quickly add up and throw off your budget. While you may have planned for major expenses like flights and hotels, smaller, hidden fees can add substantial costs to your trip. Common examples include:

- ATM Charges: Withdrawing money abroad can result in hefty fees from both your bank and local ATMs. Always check with your bank about international withdrawal fees and look for ATMs that don’t charge excessive surcharges. You can also consider using a travel credit card that offers fee-free foreign transactions to help mitigate this cost.

- Currency Exchange Rates: Currency exchange rates can vary significantly depending on where you exchange your money. Airport exchange booths and tourist hotspots tend to offer less favorable rates. It’s best to use local ATMs for better exchange rates or plan ahead by getting a good rate before you leave home.

- Service Fees: Some services, such as booking accommodations or tours, might include hidden service fees or taxes that aren’t clearly outlined at the time of booking. Be sure to read the fine print when booking anything, and factor these fees into your travel budgeting template to get a clearer picture of your total costs.

2. Ignoring Essential Costs

Many travelers focus on the obvious expenses and forget to account for the essential ones, which can lead to serious budget problems. Don’t fall into the trap of underestimating these costs:

- Travel Insurance: While it may seem like an unnecessary expense, travel insurance is a crucial part of any trip. It can cover everything from medical emergencies to trip cancellations and lost luggage. Neglecting to include this in your budget can lead to unexpected financial strain if something goes wrong during your travels.

- Visa Fees: Depending on where you’re traveling, visa fees can be a significant expense. Some countries require visas to be paid for in advance, while others may allow you to obtain one on arrival. Be sure to research visa requirements for your destination and budget for these fees accordingly in your travel budgeting template.

- Emergency Fund: Unforeseen situations, such as medical emergencies, natural disasters, or travel delays, can derail your trip if you’re not prepared. It’s important to set aside an emergency fund to cover any unexpected costs that may arise during your travels. This fund should be separate from your regular spending money and should be easily accessible if needed. Your travel budgeting template will help you clearly allocate this buffer amount.

3. Overlooking Small Expenses

While large expenses like flights and accommodation tend to be top-of-mind when creating your budget, small, everyday costs can accumulate and eat into your budget faster than you realize. Common overlooked expenses include:

- Snacks and Drinks: Whether you’re grabbing a coffee on the go or snacking between meals, small purchases can quickly add up. These costs are easy to forget, but over the course of your trip, they can make a noticeable impact. Track these expenses with your travel budgeting template and aim to limit unnecessary spending by planning meals ahead of time and carrying snacks.

- Tips and Gratuities: Tipping customs vary widely across cultures, and it’s important to account for these expenses in your budget. In some destinations, tips are expected in restaurants, for hotel staff, and for tour guides. Research the tipping culture of your destination and include these amounts in your travel budgeting template to avoid any surprises.

- Local Transportation: Public transportation, taxis, and rideshare services can quickly add up, especially in larger cities or remote destinations. Be sure to budget for local transport and consider purchasing passes or tickets in advance to reduce costs. Track your daily spending in your travel budgeting template to ensure you stay within your transportation budget.

4. Regional Pitfalls

Each destination has its own set of unique challenges and hidden costs that can throw off your budget. It’s essential to be aware of regional pitfalls to avoid financial surprises:

- Seasonal Price Hikes: Prices for accommodations, flights, and activities can vary greatly depending on the season. Traveling during peak tourist season can result in much higher costs than during the off-season. To avoid overspending, research your destination’s high and low seasons, and plan your trip accordingly to take advantage of lower prices. Your travel budgeting template can help you adjust for these seasonal changes.

- Cultural Misunderstandings: In some countries, cultural norms might influence your spending without you even realizing it. For example, in some destinations, there may be an expectation to purchase items from street vendors or local markets, even if you don’t plan to buy anything. These small costs can add up and affect your budget, so it’s important to understand the cultural expectations around spending and adjust your travel budgeting template accordingly.

- Payment Preferences: Different countries have different preferences when it comes to payment methods. While credit cards may be widely accepted in some places, others may rely more on cash or mobile payment systems. Failing to prepare for these preferences can lead to unexpected fees or the inability to pay for certain services. Research the most commonly used payment methods in your destination and ensure that your travel budgeting template accounts for these preferences.

By avoiding these common budgeting mistakes and regularly using your travel budgeting template, you’ll have a better chance of staying on track with your finances during your travels. The key is to track all costs, including hidden fees, essential expenses, and small but frequent purchases, to ensure that you stay within your budget. Understanding the unique costs and cultural nuances of your destination will also help you avoid unexpected financial pitfalls. With a little attention to detail, your travel budgeting template can help you plan a stress-free and enjoyable travel experience.

Adapting Your Budget During Travel

Even the most carefully planned travel budget can encounter challenges once you’re on the road. Unforeseen expenses, price fluctuations, or changes in plans may require you to adjust your spending. By regularly reviewing your travel budgeting template and staying flexible with your budget, you can navigate these situations with ease and ensure you stay on track.

1. Mid-Trip Budget Check-Ins

One of the best ways to stay on top of your budget is through regular reviews of your spending. Setting aside time for a weekly budget check-in can help you assess whether you’re staying within your planned limits and allow you to make adjustments as needed.

- Weekly Reviews: Schedule a time at the end of each week to go through your travel budgeting template and compare your actual spending against your planned budget. This will give you a clear picture of where you stand and help you identify areas where you might be overspending or where you have room to adjust.

- Spending Adjustments: If you find that you’re spending more than expected in one category, like dining or activities, you can adjust by cutting back in other areas. For example, if you’ve spent more on food, you might reduce the amount allocated to shopping or activities in the coming weeks. Regular reviews allow for quick adjustments, helping you stay within your budget.

2. Handling Unexpected Expenses

Unexpected expenses can arise during any trip, from medical emergencies to unplanned activities or sudden price hikes. When these situations occur, it’s essential to have a plan in place to manage them without derailing your entire budget.

- Emergency Fund Usage: One of the key benefits of including an emergency fund in your travel budgeting template is that it gives you a financial buffer to rely on when unexpected costs arise. Whether it’s an urgent medical bill or an unplanned change in your travel plans, your emergency fund can help cover the cost without affecting your day-to-day budget. Just be sure to keep track of how much you’re using from this fund and replenish it if possible.

- Cost-Cutting Strategies: If you encounter an unexpected expense, look for ways to offset other costs. For example, if you suddenly need to pay for additional transportation, you might cut back on dining out by opting for cheaper meals or cooking your own food. If you need to pay for an emergency flight change, consider reducing expenses on activities for the remainder of your trip.

- Reallocations: Reallocating funds within your travel budgeting template can help you maintain financial balance. If you’ve spent more in one category, try shifting money from another area that’s under budget. For example, if you’ve spent more on accommodation than planned, you could reduce your spending on activities or food for the remainder of the trip. Reallocating funds as necessary ensures that you don’t run out of money in any specific category.

3. Adjusting for Price Variations

Prices for various travel expenses can fluctuate based on factors like seasonality, local events, or currency exchange rates. Staying flexible with your budget and adjusting to these variations will allow you to make the most of your trip without overspending.

- Daily and Category Limits: If you’re traveling to a destination where prices change based on the time of year, you may need to adjust your daily limits or allocate funds differently between categories. For example, if hotel prices increase during a local festival, you might spend less on activities and allocate more funds to accommodation. Similarly, if certain activities or tours are more expensive during peak season, consider shifting your focus to free or lower-cost options.

- Stay Flexible: Using a travel budgeting template allows for flexibility because it’s easy to modify and update your budget as needed. If you realize that an activity you’ve planned for is more expensive than anticipated, adjust your template to reflect the new prices and reallocate funds. Stay open to changing your plans to fit your budget while still ensuring an enjoyable trip.

Adapting your travel budget during your trip is a natural part of the process, and having a flexible, dynamic travel budgeting template will help you manage any unexpected changes. By checking in with your budget regularly, using your emergency fund wisely, reallocating funds, and adjusting for price variations, you’ll be able to navigate the financial ups and downs of travel without losing sight of your financial goals. Remember, budgeting isn’t about being rigid, it’s about being adaptable and ensuring that you can enjoy your trip while staying financially responsible.

Planning a travel budget is one of the most effective ways to ensure that your adventures remain stress-free and financially manageable. By setting clear financial goals, tracking your expenses with a travel budgeting template, and staying flexible with your spending, you can enjoy a more organized and memorable trip.

Use the free travel budgeting template to simplify your planning process. This tool allows you to allocate funds, track expenses, and make adjustments with ease, ensuring you stay within your budget without missing out on experiences.

- Plan thoroughly by setting a realistic budget before your trip.

- Track your expenses regularly using a travel budgeting template.

- Stay flexible with your budget, adjusting as needed for unexpected costs or price variations.

With the right preparation and tools, you can confidently embark on your travels knowing that your finances are well-managed. Happy travels!